For Investors

Global Capital, Local Insight.

The Kisobase Advantage for Investors:

Standardized Underwriting

Every listing is processed through our Analyst engine. We normalize erratic Japanese data into a standard B2B format.

- Metric Conversion: $Price/sqft$ and $Gross/Net Yield$ calculated at real-time FX rates.

- Localized Specs: No more "Mansion" or "Toho"—we provide "Condos" and "Walking Distance."

Risk Intelligence

We identify structural and legal deal-breakers before you spend on a surveyor.

- Seismic Check: Instant identification of Kyutaishin (Pre-1981) risk.

- Land Title: Clear distinction between Freehold (Shoyuken) and Leasehold (Shakuchiken).

Institutional Concierge

Direct access to Japanese developers with bilingual support to handle initial inquiries and document requests.

Pricing

Deal Hunter

-

Access to "Red Flag" reports & Net Yield calculators.

Family Office

-

First-look at off-market deals & Liaison services.

Frequently Asked Questions

How does the JPY/USD conversion work on the platform?

All property prices and yields are converted using a live mid-market exchange rate. Note that these are for analytical purposes only. Your final purchase price will be settled in JPY based on the rate provided by your lending or remittance bank at the time of closing.

What exactly does the "Red Flag" scanner verify?

Our analysts review the Zenkoku (National) land registry and building records to identify three critical risks: Seismic standards (Pre-1981), Land Title (Leasehold vs. Freehold), and Rebuilding Restrictions. This is a pre-screen to save you time before you pay for a full professional Due Diligence (DD) report.

Can a foreigner legally own freehold land in Japan?

Yes. Unlike many other Asian markets, Japan has no restrictions on foreign individuals or corporations owning freehold land (Shoyuken). There are no "Golden Visa" requirements or local partnership mandates.

What are the standard closing costs for a B2B transaction?

Typically, you should budget for 5% to 8% of the purchase price. This includes the Brokerage Fee (3% + ¥60k), Registration Tax, Stamp Duty, and Judicial Scrivener fees.

For Developers

Bring your projects to the world

The Kisobase Advantage for Developers:

Asset Institutionalization

We don't just "translate." We rewrite your property data to match the expectations of institutional acquisition managers in Singapore, HK, and the US.

Targeted Exposure

Your inventory is promoted directly to our vetted database of overseas investors seeking Japanese exposure.

Bilingual Lead Management

We act as the first line of communication, filtering inquiries and ensuring you only deal with qualified buyers.

Pricing

The Analyst Pro

-

Mid-tier developers needing localization.

Frequently Asked Questions

Do I need to provide materials in English?

No. Our "Analyst Pro" service handles the full localization. You provide the Japanese Sales Graphic (Mai-soku) and Rent Roll, and we convert them into an institutional-grade English listing.

How do you vet the quality of overseas investors?

We require all "Family Office" and "Institutional" tier users to undergo a basic KYC (Know Your Customer) check. We prioritize inquiries from investors who have a clear "Buy Box" and proof of funds.

Who handles the communication with the buyer?

The KisoBase Analyst acts as your first-line liaison. We filter initial questions and ensure that when a lead reaches your desk, they are qualified, informed, and ready to discuss technical details.

Is there a success fee for sales?

Kisobase is a platform and data provider. While we offer liaison services, we are not a traditional brokerage. Fees are typically flat-rate based on your subscription or listing tier, unless a custom "Capital Introduction" agreement is signed.

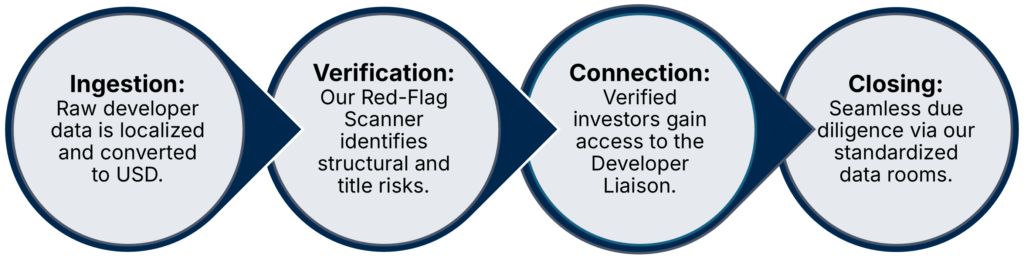

Our Methodology: From Discovery to Acquisition

Bridging the gap between raw Japanese market data and global institutional standards.

Institutional Risk Screening

Due Diligence at a Glance: We identify critical structural and legal 'Red Flags' before you deploy capital.

Pillar 1: Structural & Safety (Hardware)

Kyutaishin Standard

Slab-Down Piping

Hazard Zone Status

Pillar 2: Title & Legal (The Black Box)

Shakuchiken (Leasehold)

Saikenchiku Fuka

Missing Boundaries

Pillar 3: Financial & Operational (The Bottom Line)

Underfunded Reserves

Standard Lease Terms

Management Insolvency

Access the Terminal

Join the platform to analyze localized data, calculate JPY/USD yields, and review structural “Red Flags” on institutional-grade assets.

Globalize Your Assets

Connect your inventory with international capital. We institutionalize your data for English-speaking acquisition managers and funds.

Standardizing the Japanese Real Estate Market since 2026.